Activate your Wells Fargo Credit/Debit Card through various modes:

Wells Fargo & Company is an American multinational financial service founded in the year 1952, that offers a variety of cards to choose from with a lot of cash backs and other features. This bank has a total of 4900 branches all over the 37 states and the District of Columbia.

This article will provide you with the different cards offered by the bank and the unique features of the cards as well as the overall benefits so that you can choose to form the card you want to get. Here the activation procedure of the card is given through various modes as well as the payment options for your credit card bills. But if you are opting for a card where you can build your credit score or have a poor credit history, then this article is not for you, since you won’t be provided that card from them.

Not only credit cards, you are also offered debit cards that can be customized according to your will by giving a photo on the card, be it anyone you love. You can make purchases, get the cash and manage your money at the ATMs, where you get access to more than 12,000 ATMs by using a card or a digital wallet. The best feature of adding your debit card to the digital wallet is that you can get access to ATM right from your phone. The card can be used to pay your bills at participating retailers and service providers that can be made online or by phone.

Below given are the certain Wells Fargo credit Cards with their features:

- Wells Fargo Reflect Card – this card won’t offer you an intro bonus and comes with an APR of 12.99%-24.99% and does not need any annual maintenance.

You are supposed to get 0% APR for purchase and balance transfer for the first 21 months after you have opened your account.

- com Rewards Visa Credit Card – for the intro bonus, you will get 2 reward nights which is worth of $250. This card has no annual fee and has an APR of 14.99%-22.99%.

- Wells Fargo Active Cash Rewards Card – this card need no annual fee and comes with a bonus of $200 cash rewards. It has a regular ARP of 14.99%-24.99% and you will get 0% APR for the purchase and balance transfer in the first 15 months.

- Wells Fargo Business Platinum Visa Card – this card need no annual fee and has a regular APR of 11.24%-21.24%. You can earn 1.5% cash back on spending $1. You will be getting 0% APR for purchase and balance transfer for the first 9 months. For the cash advance APR you need to give 23.99%.

- Wells Fargo Cash Back College – the card need no annual fee and comes with a regular APR of 11.15%-21.15%. If you spend a total of $2500 on gas, grocery and drugstore within the first 6 months, then you will receive a cash rewards of 3%. You will get a 1% cashback for spending $1 on all other purchases with your card. For the first 6 months, you don’t need to pay for the APR on purchase and balance transfer. For the balance transfer fee, you have to pay 5% or $5 for each amount, based on whichever is higher. You have to pay a fee of 3% for the foreign transaction.

After learning of some of the Cards offered by Wells Fargo Bank, let us take a look at the overall benefits:

- It has a feature of My Spending Report that keeps a track of your spending habit, income, payments and withdrawal.

- The cards offer a feature of Go Far Rewards, where after earning a good amount of rewards, you can redeem them for cash, gift cards, merchandise and so more.

- The card also gives you the opportunity to share your rewards with others.

- The cards offer you a cell phone protection feature, where you are offered up to $600 after a deduction of $25 when you pay your phone bills with the card.

- If you are having any emergency, then the card will offer you travel and emergency assistance services.

Credit score required to qualify for the Card:

If you want to have any of the above cards, then you need to have a good score of 670 and above. If you don’t have a credit history or want to build one, then this card won’t offer you that.

Activation of Wells Fargo Debit/ Credit Card – if you have received your card, then you have to activate it. For the activation procedure, you can choose any of the steps according to your convenience.

- Online

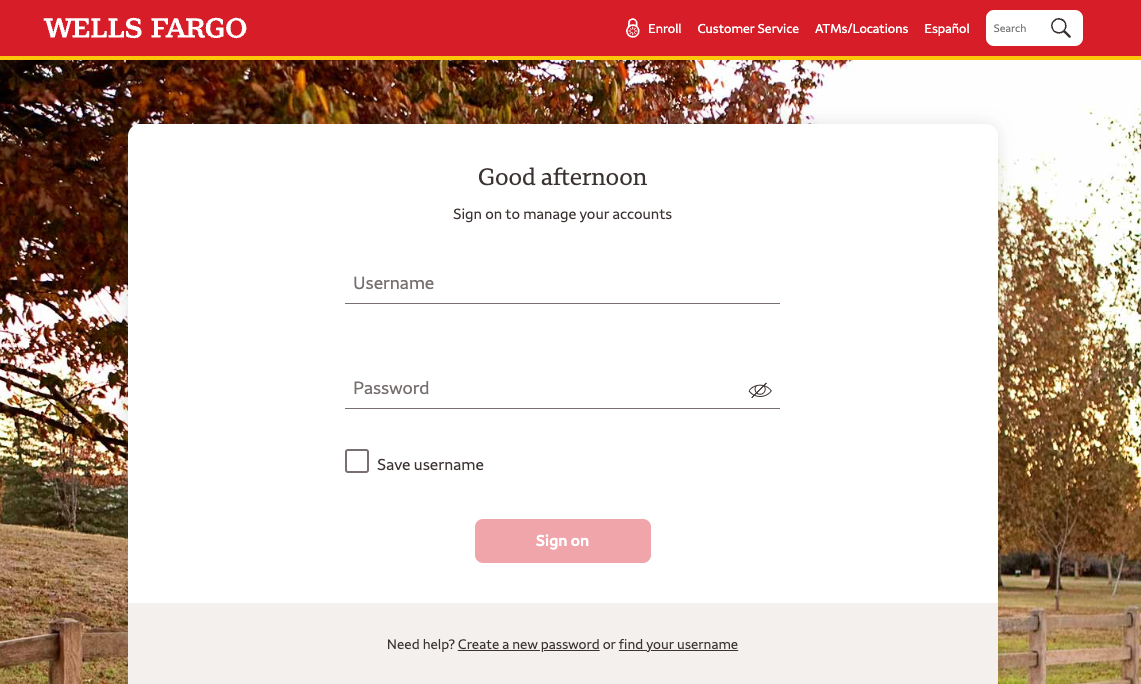

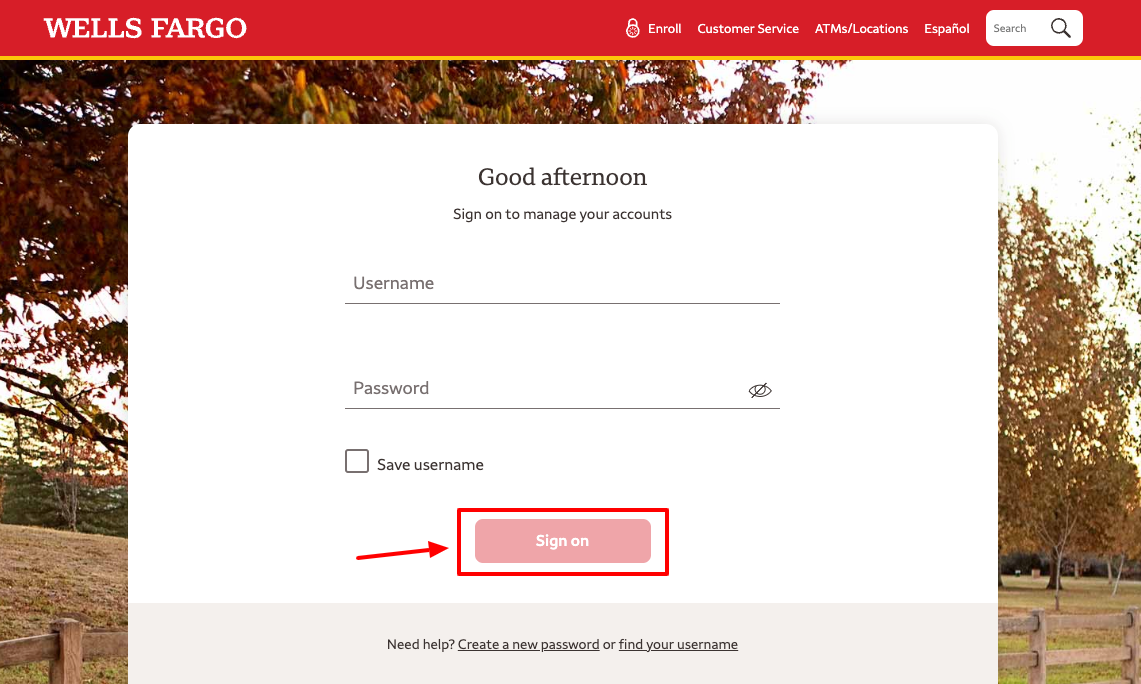

- First you have to go to the activation website of Wells Fargo Card using your mobile or laptop or you may use the link www.wellsfargo.com.

- You have to click on the Menu button on the top right-hand side and click on Sign-in, or directly go to the wellsfargo.com/activatecard page.

- Then you have to log in to your account give the username and password and then click on the button Sign on.

- Then you have to fill the following details – card number, social security number, card expiry date, card holder’s name.

- After you have given all the credentials, you have to submit the form after you have checked it once.

- Phone – for the activation of the card on phone, you have to make a call on the number 1-877-294-6933, as you call on the number, the customer service representative will guide you through the activation procedure, where you have to provide the details as asked and then the card will be activated.

- Wells Fargo App – you can download the app on your mobile (Android and iOS). There you have to login to your account, where you have to give your Username and password same as the online account, and you will be able to activate the card following the prompts.

The above methods are applicable for both the credit and debit card, but you can also opt to activate your debit card using the PIN at your nearest ATM. The PIN and the card will be sent to you separately. You have to use the card at the ATM giving the valid PIN. Once the card is used, it ill automatically be activated.

Payments for the Well Fargo Credit Card bills:

- Mail – you can send the payment by mail, where you need to send a money order or check and you need to write your account number on the check on the following address –

Wells Fargo Consumer Credit Card Services

P.O. Box 51193

Los Angeles, CA 90051-5493

Make sure you make the payment 7-10 days before the due date so that you don’t have to give any late fine.

- Phone – you can also make the payment by phone where you have to call on the number 800-869-3557.

There are other ways where you can make the payment through online, MoneyGram, Western Union Quick Collect or with a transfer from the bank. You have to give you payment on time since you will be charged up to $40, moreover, if the check is returned, then you have to make a payment of $40.

Also Read: Accept Your U.S. Bank Credit Card Offer

Some Frequently Asked Questions (FAQs):

Q. How will I increase my credit line?

Ans. You need to call on the number 1-800-642-4720 to increase the credit limit.

Q. How will I settle a dispute on my credit card?

Ans. You have to call on the number 1-800-390-0533, or you have to create the online account and sign in and go to the More menu and then to the Account Services, and then you have to click on the Dispute a Transaction.

Q. What shall I do if my credit card gets stolen?

Ans. If you have lost your card or it was stolen, then you have to call on the number 1-800-642-4720 which is available for 24 hours and report it immediately.

One thing to be noted is that after you have received your new card with an account number, you can continue to make payments except or the ones in dispute. If your card is enrolled for overdraft protection or automatic payment, then you would have to wait for about 72 hours until your new account is made.

Q. How am I supposed to turn on or off my credit card?

Ans. If your card got misplaced or stolen, then you will be able to turn off your card temporarily using the mobile app to prevent any unauthorized transactions. You can even sign in to your online account to do so.

Q. What shall I do if I haven’t received my PIN?

Ans. If you haven’t received the PIN, then you have to call on the number 1-800-869-3557.

Conclusions:

This article give you the features of the different card, benefits and activation procedure of the credit card. If you face any further problems while going through the card, then you have to call on the customer care service on the number 1-800-869-3557. If you have applied for the card and need to know about the application status, then you have to call on the number 1-800-967-9521.

Reference: