Amex Personal Loan Login

The American Express organization is otherwise called Amex and is an outstanding brand for Visas that gives worldwide help. It has its headquarters in, New York City, New York, United States. The organization was established in 1850 and has an income of 3,347 crores USD.

American Express is currently running a fall personal loan advancement in which cardholders can exploit a credit of up to $40,000, APRs as low as 6.98%, and fixed regularly scheduled installments. The individuals who wish to see the subtleties of their pre-affirmed offer can start by heading off to the site that appeared on the mailing correspondence. Upon landing in the site, a User ID and secret phrase can be entered to log in to a current American Express record and discover what offer is coming up. Cardholders who have overlooked a User ID or secret phrase can tap the connection supplier underneath the login fields to start the record recuperation process.

Information on American Express Personal Loans

-

Must be an inhabitant of the United States or one of its regions to be qualified

-

A few individuals may just be affirmed to utilize the advance for obligation combination

-

Candidates must be on favorable terms with American Express and in any event 18

-

Candidates have as long as 3 days after endorsement to survey and consent to the arrangement

-

Most candidates will get a choice in only minutes

It ought to be brought up that the individuals who still can’t seem to enlist for online access should do as such before looking at the American Express Loan 0 offer. So as to start the enrollment procedure, the 15-digit card number and 4-digit card ID must enter. If it’s not too much trouble note that cardholders who make a record before applying for the American Express Loan 0 offer may need to hold up a day prior to getting a rate and applying for the credit.

Eligibility Criteria for Amex personal loan

-

American Express makes unsecured personal loans up to $40,000 for pre-approved American Express cardmembers.

-

Must be pre-approved by American Express

-

At least 18 years old

-

Be the primary cardholder on an American Express personal credit card

-

Have an online American Express account

-

Be in good status with American Express at the time of loan application

Rates of Amex personal loan

-

Loan Amount Range- $3,500 – $40,000

-

APR Range: 6.90% – 19.98%

-

No origination fee

-

Late payment fee: $39

-

NSF/returned payment fee: $39

-

No check processing fee

-

No prepayment penalty

-

Loan Terms are for 1, 2 or 3 years

-

Repayment Options are Monthly

-

Direct Payment to Creditors

Features of Amex personal loan

-

No origination fee.

-

Free credit score access.

-

Option to directly pay creditors.

-

You can pay by credit card

-

Better customer service

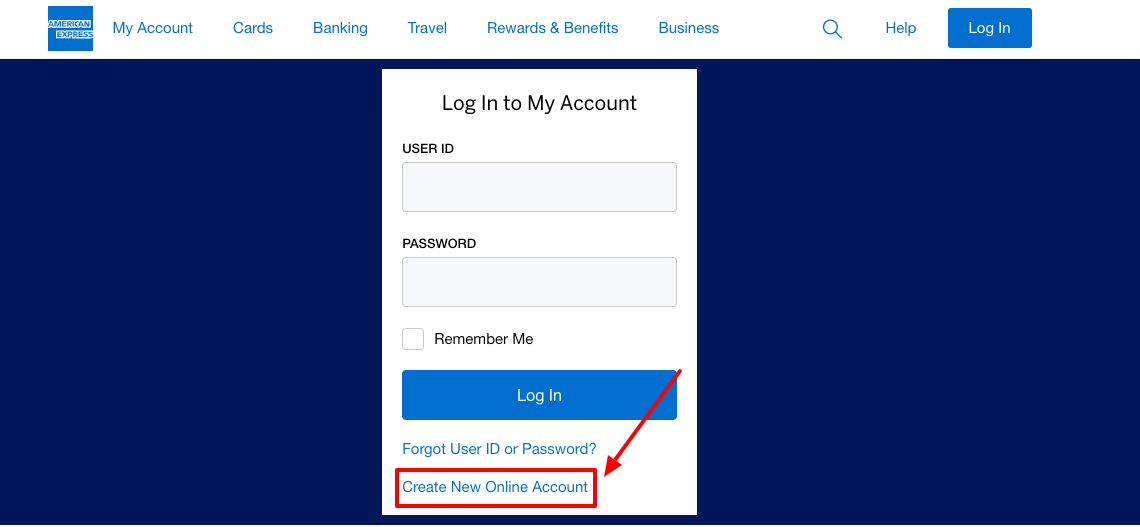

How to Create Amex Personal Loan Account

To create an account you have to venture to, www.americanexpress.com/loan

Here at the middle side under the login blanks, click on ‘Create new online account’.

On the next directed page, enter

-

The 15-digit card number and click on ‘Confirm’.

-

4-digit card ID

-

If you don’t have the 4 digit card ID then click on ‘Don’t have a 4-digit card ID?’.

-

Here you have to input the billing address postcode

-

15-digit card number and click on ‘ Confirm’.

You need to follow the prompts and you will be able to create an account

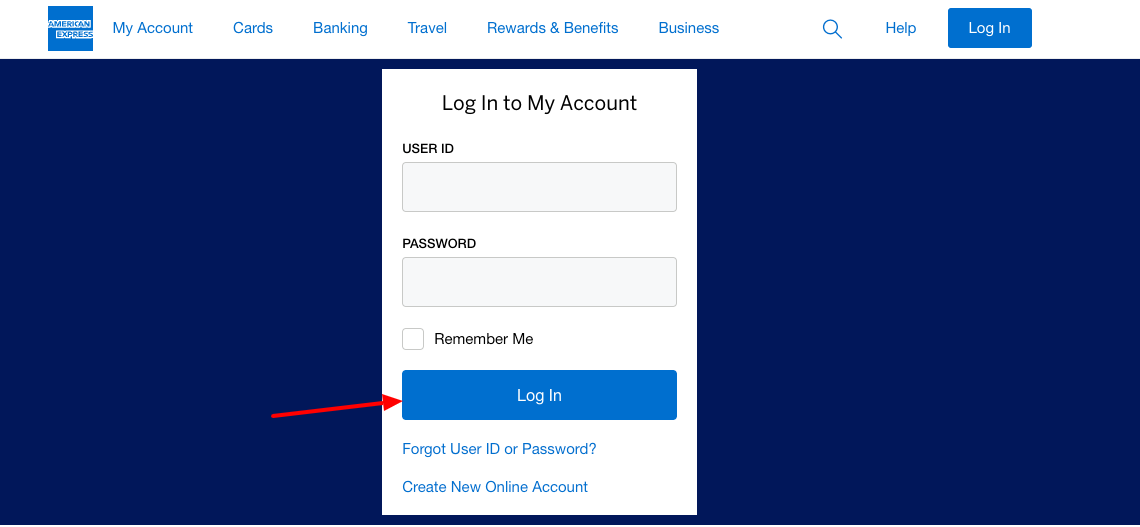

Amex Personal Loan Login Process

-

To log in, you have to visit, www.americanexpress.com/loan

-

Here on the page, on the middle side type

-

The user ID, and

-

The password then,

-

Then, click on ‘Log in’

You will be logged in

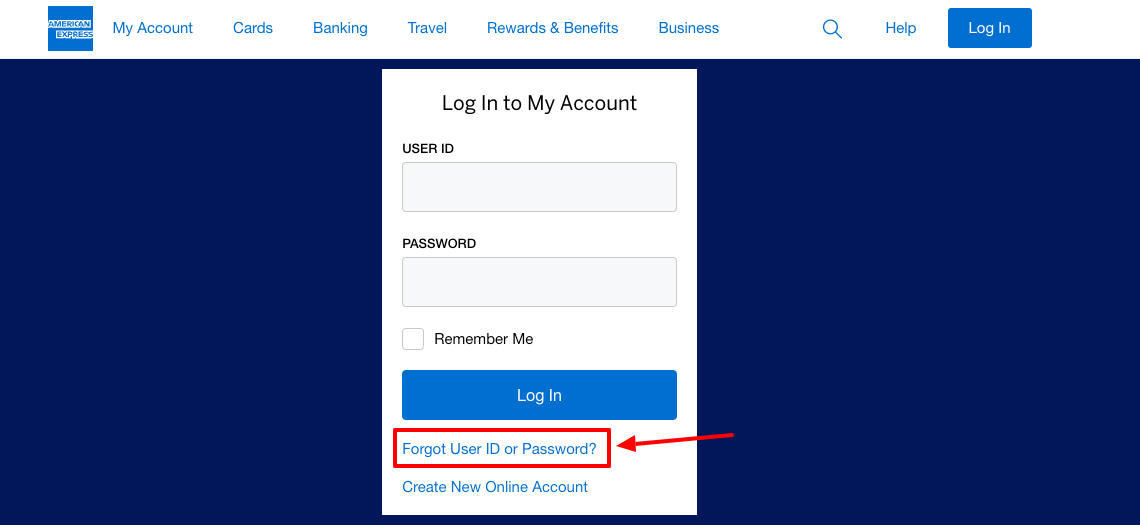

How to Reset Amex Personal Loan Account Details

In case you have lost the logging info, then you have to visit the same page as before, and in the login, box click on, ‘Forgot user ID or password?’. Here type,

-

The 15-digit card number

-

The 4-digit card ID

-

Then, from the bottom right side, click on, ‘Continue’ in blue.

You have to follow the later prompts and you will be able to get the details back.

Also Read:

Pay your TECO Peoples Gas Bill Online

How to pay your FirstEnergy Bill Online

Amex Personal Loan FAQs(Frequently Asked Questions)

- What are American Express Personal Loans?

American Express or Amex Personal Loans are unsecured loans that can be used for personal, family, or household purposes. such as loan existing credit card debt or for major purchases, home renovations, repairing, or significant life events.

- What can I not use my loan funds for?

Personal Loans may not be used for education expenses, real estate, business, securities, or vehicle purchases (other than as a down payment for a vehicle).

- How much can I borrow?

As of now, you can apply for a Personal Loan of at least $3,500, up to the maximum eligible loan amount, which depends on your credit score and other factors at the time of applying. Your maximum eligible loan amount will be displayed when you view your offer on the application page.

Customer help

To get better help, you can call on these numbers,

-

800-297-3276

-

888-800-8564 (for corporate cards)

Reference