With over a hundred years of working together in all features of home loan and banking tasks, they are industry-evaluated and examined routinely by autonomous outsiders. Their duty to consumer loyalty, collaboration, and viable administration keeps on procuring them the main situation in the sub-servicing arena. Their esteemed representatives get continuous preparation and schooling to guarantee they give the best client support, the most learned administrative counsel, and the largest scope of sub-servicing items accessible in the business.

Why Choose Cenlar

- Committed supervisory crew

- Talented overhauling experts

- Industry experience

- Solid duty to client care

Register for Cenlar Account

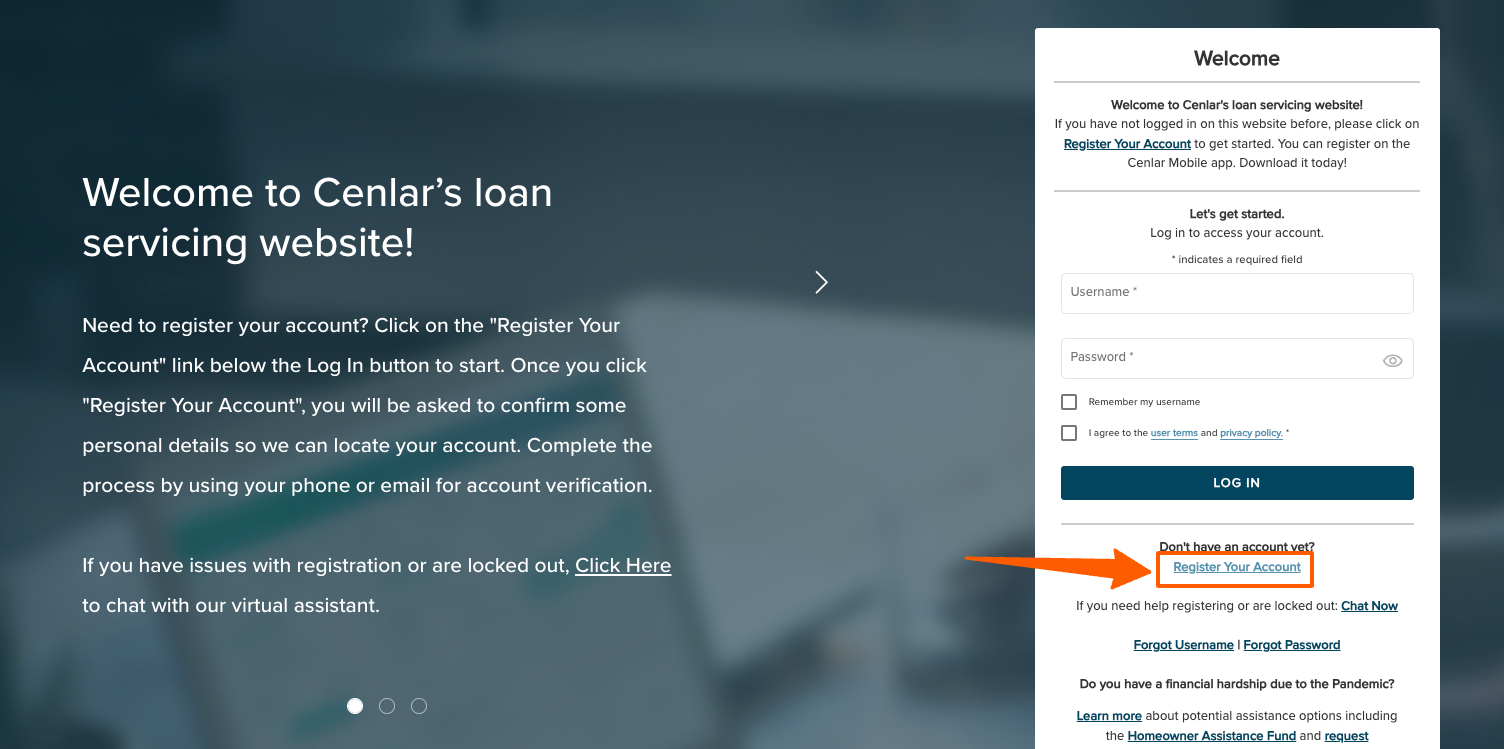

- To register for the account open the webpage www.cenlar.com

- Then go to your Cenlar Login page.

- As the page opens on the login homepage click on the ‘Register your account’ button.

- In the next screen provide your last name, SSN, date of birth, and email, and click on the ‘Next’ button.

Cenlar Online Bill Pay Login Process Online

- To pay the bill online open the page www.cenlar.com

- After the page appears at the center click on the ‘Homeowner login’ button.

- In the next screen, you have to provide the required login details and proceed with the prompts.

Cenlar Business Client Login

- To login into this account open the page www.cenlar.com

- Once the page appears click on the ‘Client login’ page.

- Username and password Click on the ‘Accept and login’ button.

Cenlar Bill Phone Payment

- To pay the bill by phone you have to call a specific number

- Phone number: 800-223-6527.

Also Read

Capital One Auto Finance Bill Pay Guide

MyLowesLife Login Process Online

Cenlar Insurance Advantages

- A Home Loan Makes Home Possession Moderate: Buying a house is probably going to be the greatest buy you’ll actually make and a home loan will be your biggest obligation. Since you can spread the reimbursements on your home credit over endless years, the sum you’ll take care of consistently is more reasonable, and affordable! Traditionally, when individuals take out their first home loan, they would in general decide on a long term.

- No Guidelines: about this and as we are living longer and the retirement age is going up, 30-year contracts are getting more normal. This can help cut your regularly scheduled installments down, however, on the other side, you’ll be burdened with the obligation for more.

- A Home Loan Is a Practical Method of Getting: Interest rates on contracts will in general be lower than some other type of acquiring on the grounds that the credit is made sure about against your property. This implies the bank or building society has the security that on the off chance that everything turns out badly and you can’t reimburse it there is as yet something significant – your property to offer to repay a few, if not all, of the home loan.

- Financing Costs: On contracts are continually changing throughout the long term they’ve been higher than 15% and lower than 2%. Fixed-rate and tracker contracts will, in general, be the most mainstream, however, there are additional markdown and counterbalanced home loans.

- You’ll Take Care of a Lot More Than You Initially Obtained: The clearest inconvenience is that you are conveying a huge obligation for quite a while. The other significant downside is that since the home loan is made sure about on your property, you must have the option to stay aware of your home loan reimbursements or you could lose your home.

- During The Credit Crunch: banks took a stab at keeping even those battling with home loans in their home. Yet, in the event that mortgage holders truly can’t make the reimbursements, their homes will be repossessed. The bank or building society will at that point offer it to recuperate their cash.

- Watch Out for Expenses: It’s not just the expense of interest that mounts up when you have a home loan. Charges can likewise be strong. There will be set-up costs each time you take out another home loan and these change fundamentally yet some are as high as £2,000.

Cenlar Contact Details

For further details call on the toll-free number 1-800-223-6527.